Page 1 of 1

Urgent help - Employment status for naturalisation

Posted: Wed Sep 24, 2014 9:54 am

by vijayballa

Hello all,

I'm going to apply for BC at NCS next week. and filling the application form, I am not entirely sure what to fill in Occupation.

I am basically a IT consultant. I was in permanent employment between Apr 2009-May 2014 and I've got P60s for these 5 years.

But I started contracting and now have my own limited company. I am the director and also an employee from last 4 months (I pay NI contributions with PAYE).

I am confused about what to say in the application. If I say

1. Employee - looks straightforward. I can submit my last 5 years P60s and payslips for last 4 months (in my own company)

2. Director - I don't have tax returns yet as I have not completed 1 year. not sure if NCS will ask any documents to support this?

Please suggest which option above is better in my case.

I really appreciate your time and thanks in advance.

Re: Urgent help - Employment status for naturalisation

Posted: Wed Sep 24, 2014 10:34 am

by 19eggs

Hi!

I guess this post of mine will help you.

http://www.immigrationboards.com/britis ... l#p1089947

1. You are an employee and a Director at the same time.

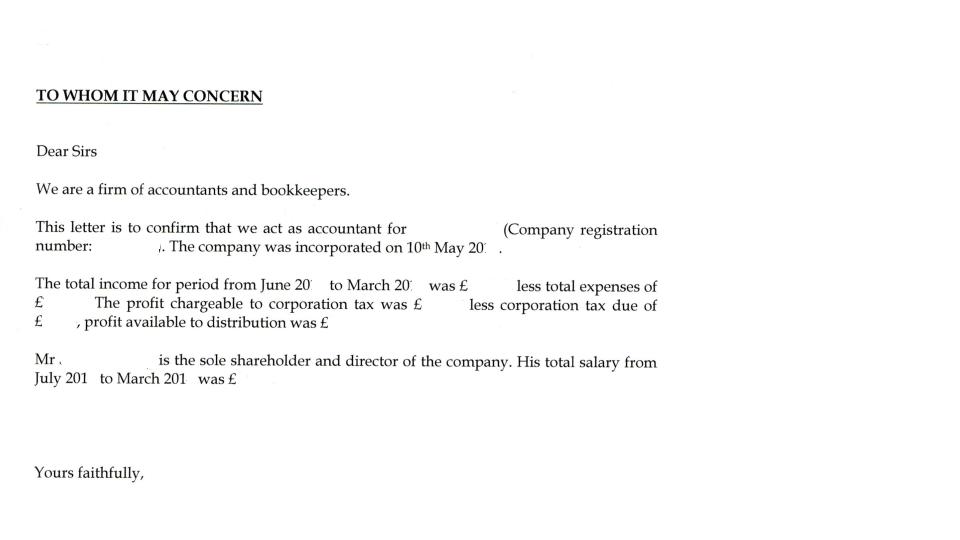

2. Get a letter from your accountant if you have stating the date of company incorporation, expected income/turn over, etc.

Hope this helps.

Re: Urgent help - Employment status for naturalisation

Posted: Wed Sep 24, 2014 12:11 pm

by vijayballa

Thanks a lot for your reply 19eggs.

I will have to get the letter from the accountant if thats the best option.

Any more suggestions by any one please?

Re: Urgent help - Employment status for naturalisation

Posted: Wed Sep 24, 2014 9:03 pm

by vijayballa

Hi 19eggs and all,

Regarding the letter from the accountant, does the accountant need to be an approved accountant or some thing?

I'm not using any accountant organisation as such to manage my company accounts but using a freelancer instead. I'm sure he can prepare a document for me but not sure if he needs sign as a professional accountant.

Please clarify just this bit.

Many Thanks

Re: Urgent help - Employment status for naturalisation

Posted: Thu Sep 25, 2014 11:46 am

by sirish0909

Hi 19eggs,

I am exactly in a similar situtaion of Vijayballa after reading your various post I thought to do the below.

1. For Section 3 Good character Requirement for 3.2 I will tick Employee and Director and also I will provide the below notes in page 15, Please advise if this is correct? or advise me for any changes. (Not providing any self assement from accountant as you have mentioned in your earlier post that NCS have not taken any of the additional documents)

From Nov 2008 to Aug 2013 I was working as an Employee and please see the evidence of tax and NI paid (I have a letter from HMRC with my employment history showing my earrning and tax paid) but from Sep 2013 I have started my own Ltd company and my company tax returns will be completed before May 2015 in line with HMRC deadline (Evidence attached from HMRC to complete the tax returns) and please let me know if in case you need any further evidence or supporting documents.

Vijayballa, Please also confirm what are you planning to do?

Note: I got an Appointement at Redbridge council on 01/10/2014

Thanks,

Sirish

Re: Urgent help - Employment status for naturalisation

Posted: Thu Sep 25, 2014 12:19 pm

by vijayballa

Hi Sirish,

I am still in two minds actually. either to select Employee or Director. As there are no strict rules for Employment status compared to ILR and Tier1 applications, we should not be worried about this. but still as any one else, I want to give them the right information.

ButI will speak to my accountant today and see if he can provide a document with "company incorporation, expected income/turn over, etc". but as I mentioned before, I am not sure is there a concept of "approved accountants" to provide the documents.

If I tick Director as the status then I would try to submit the following

1. Letter from Accountant

2. Corp tax reminder document from HMRC

3. VAT Certificate (I'm going to pay the VAT before 2nd Oct and my NCS appointment is on 3rd Oct)

4. Payslips from my own company

but not sure what are all the docs above will NCS take.

Thanks

Re: Urgent help - Employment status for naturalisation

Posted: Thu Sep 25, 2014 3:07 pm

by 19eggs

vijayballa wrote:Hi 19eggs and all,

Regarding the letter from the accountant, does the accountant need to be an approved accountant or some thing?

I'm not using any accountant organisation as such to manage my company accounts but using a freelancer instead. I'm sure he can prepare a document for me but not sure if he needs sign as a professional accountant.

Please clarify just this bit.

Many Thanks

Hi! Vijayballa,

I am not sure if you need an accountant registered with a professional body. I read somewhere that the accountant needs to put his/her's professional body's name. I think this case is true when an accountant becomes a referee.

Mine is registered with ACCA and have their own company so it was not a problem.

I have attached the letter what my accountant wrote.

- accountant-letter.JPG (35.43 KiB) Viewed 1973 times

I think as long as you have complied with HMRC then you should be fine. Infact you can do your own accounts if you wish so I don't think the accountant needs to be registered.

Re: Urgent help - Employment status for naturalisation

Posted: Thu Sep 25, 2014 3:13 pm

by sirish0909

Hi 19eggs and seniors

Would you be able to advise what I am planning to do sounds good? if not please advise.

Thanks,

Sirsh

Re: Urgent help - Employment status for naturalisation

Posted: Thu Sep 25, 2014 3:15 pm

by 19eggs

sirish0909 wrote:Hi 19eggs,

I am exactly in a similar situtaion of Vijayballa after reading your various post I thought to do the below.

1. For Section 3 Good character Requirement for 3.2 I will tick Employee and Director and also I will provide the below notes in page 15, Please advise if this is correct? or advise me for any changes. (Not providing any self assement from accountant as you have mentioned in your earlier post that NCS have not taken any of the additional documents)

From Nov 2008 to Aug 2013 I was working as an Employee and please see the evidence of tax and NI paid (I have a letter from HMRC with my employment history showing my earrning and tax paid) but from Sep 2013 I have started my own Ltd company and my company tax returns will be completed before May 2015 in line with HMRC deadline (Evidence attached from HMRC to complete the tax returns) and please let me know if in case you need any further evidence or supporting documents.

Vijayballa, Please also confirm what are you planning to do?

Note: I got an Appointement at Redbridge council on 01/10/2014

Thanks,

Sirish

Hi! Sirish,

I think that is more that sufficient. To be honest you don't need to give details of your permanent employment. As you have given your NI number they can find it from there. The lady at the NCS told me not to give unnecessary documents and she did not take my accountant's letter. It was a waste. I too was worried but I received the approval close to 6 weeks.

I think I ticked Employee and Director. My accountant said, I am an Employee as I get salary from the company and I am the Director too.

Re: Urgent help - Employment status for naturalisation

Posted: Thu Sep 25, 2014 3:48 pm

by sirish0909

Thanks 19eggs... you are a star

Re: Urgent help - Employment status for naturalisation

Posted: Thu Sep 25, 2014 9:32 pm

by vijayballa

19eggs wrote:vijayballa wrote:Hi 19eggs and all,

Regarding the letter from the accountant, does the accountant need to be an approved accountant or some thing?

I'm not using any accountant organisation as such to manage my company accounts but using a freelancer instead. I'm sure he can prepare a document for me but not sure if he needs sign as a professional accountant.

Please clarify just this bit.

Many Thanks

Hi! Vijayballa,

I am not sure if you need an accountant registered with a professional body. I read somewhere that the accountant needs to put his/her's professional body's name. I think this case is true when an accountant becomes a referee.

Mine is registered with ACCA and have their own company so it was not a problem.

I have attached the letter what my accountant wrote.

accountant-letter.JPG

I think as long as you have complied with HMRC then you should be fine. Infact you can do your own accounts if you wish so I don't think the accountant needs to be registered.

Hi 19eggs,

thanks a lot for this. I will get my accountant to give me document like yours.

hopefully it will sort out every thing.

Thanks a lot once again. you have been very helpful

Thanks

Re: Urgent help - Employment status for naturalisation

Posted: Fri Sep 26, 2014 10:51 am

by 19eggs

sirish0909 wrote:Thanks 19eggs... you are a star

No, problem. Let us know how it goes.

Re: Urgent help - Employment status for naturalisation

Posted: Fri Sep 26, 2014 10:54 am

by 19eggs

Hi 19eggs,

thanks a lot for this. I will get my accountant to give me document like yours.

hopefully it will sort out every thing.

Thanks a lot once again. you have been very helpful

Thanks

No, problem and let us know how it goes.